Tax Package Parliament Approval Sets New Era For Property And Vehicle Sales

Revisions Approved: Notary Fee Of 0.2 Percent Mandatory On Vehicle Sales; Heavier Penalties For Under-Declaring Property Values

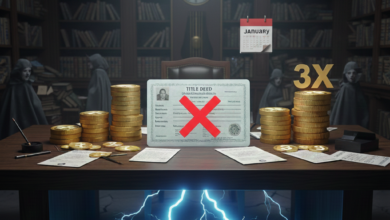

ANKARA, Turkey – The Turkish Grand National Assembly (TBMM) General Assembly has approved and enacted the omnibus bill, commonly known as the “Tax Package,” after long and contentious deliberations earlier this week. The Tax Package Parliament Approval signifies the entry into force of new obligations and regulations affecting millions of real estate and vehicle owners, set to become effective on January 1, 2026.

📝 Section 1: Critical Revisions And Exemptions

The bill was finalized after the government backtracked on some critical provisions following intense public backlash during parliamentary discussions.

- Concessions: Key disputed items, such as the removal of the rental income exemption and the full implementation of the ‘rayiç bedel’ (market value) regulation, were either withdrawn or softened through last-minute revisions to the bill.

- Heavy Sanctions for Under-Declaration: Under the new law, sanctions will be much more severe for those who declare a value lower than the actual sale price in title deed transactions. This mandates that the true sales price must be declared in real estate dealings.

🚗 Section 2: Mandatory Notary Fee On Vehicle Sales

One of the most significant changes set to take effect on January 1, 2026, concerns vehicle sales.

- New Fee: A notary fee of 0.2 percent (two per thousand) will become mandatory on vehicle sales and transfer transactions.

- Exemption: However, this 0.2 percent fee will not apply to sales made through businesses that possess an authorized trade certificate for second-hand motor vehicles (dealerships). Therefore, the fee burden will largely fall on individual citizens conducting private sales.

🌐 Section 3: New Annual License Fees

The new law introduces an obligation to pay an annual fee for specific commercial activities.

- Affected Sectors: Annual fees will be imposed on authorization certificates for jewelry, second-hand vehicle trade, and real estate trade. Furthermore, private healthcare institutions and aviation licenses will also be subject to annual fees. This increase will raise the operating costs for these regulated sectors.

🛡️ Section 4: Credibility And Fiscal Discipline

The Tax Package Parliament Approval underscores the government’s aim to increase fiscal discipline and reduce undeclared economic activity. The heightened sanctions for under-declaring property values seek to increase transparency in the real estate market.