Bank Accidentally Transfers 2.3 Million Tl To Professor’s Account! Professor Invests It And Waits

Legal Conundrum: Professor Invests Money In Daily Interest Account, Bank Only Realizes Error Four Months Later

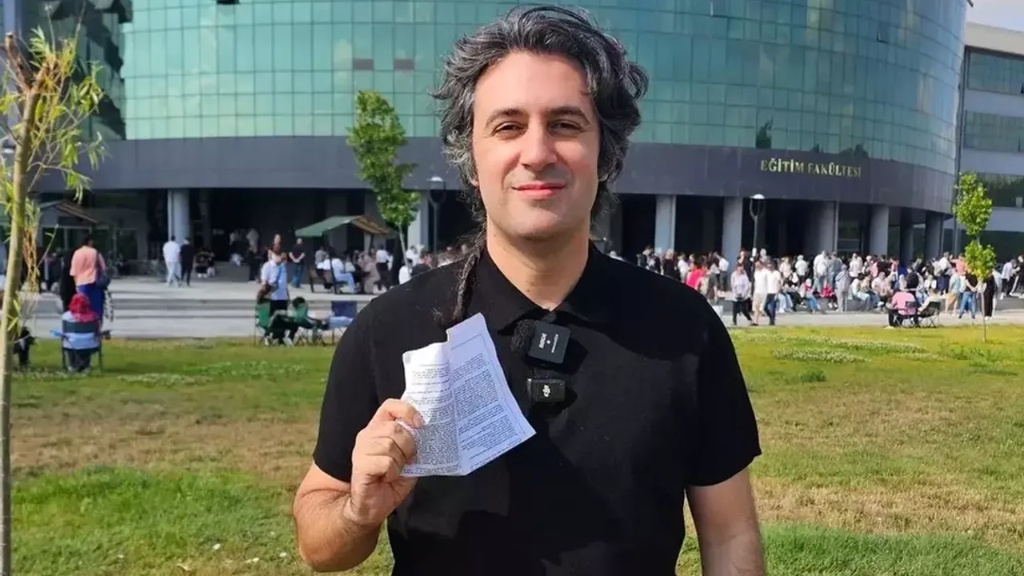

ANKARA, Turkey – A bizarre event, rarely seen in Turkish banking history, has unfolded. Dr. Cihan K., a university professor in Ankara, seemingly hit the jackpot when his bank made an erroneous transfer to his account. Due to a technical error, the bank mistakenly sent exactly 2.313 million Turkish Lira to the professor’s account. The most astonishing aspect of the incident is that the professor immediately noticed the money and, aiming to gauge the bank’s reaction, started investing the funds in a high-interest daily savings account.

💰 THE BANK’S NIGHTMARE, THE PROFESSOR’S OPPORTUNITY

The incident took place in March 2025. Dr. Cihan K. was stunned by the unexpected balance in his account. While banks typically detect and reverse such errors within seconds, this situation unfolded differently.

- The Professor’s Move: Instead of waiting for the refund, Dr. Cihan K. immediately deposited a large portion of the money into a high-yield daily savings account. He stated his goal was to observe how long it would take the bank to realize its mistake.

- Delayed Detection: The bank only discovered this massive error four months later, during an internal audit in July 2025. Bank officials immediately contacted the professor, demanding the return of the funds.

⚖️ ETHICAL AND LEGAL DILEMMA: “NOTHING HAPPENED AGAIN”

Professor Cihan K.’s statements brought the ethical and legal dimensions of the incident to the forefront:

- The Professor’s Confession: Dr. Cihan K. said, “I noticed the money arrived in my account. I waited for the bank to correct it immediately. I waited a week, then a month. Nothing happened. So, without returning the money to the bank, I started investing it in a daily interest account to profit.” When the bank finally called four months later, he summarized the situation with the phrase, “Nothing happened again.”

- Legal Status: The bank initiated legal action against the professor to reclaim the principal amount plus the interest earned. However, the fact that the bank failed to detect such a substantial error for four months, and the question of who legally owns the accrued interest, has sparked debate among legal experts. Consequently, the incident exposed significant vulnerabilities in the bank’s internal control mechanisms.

📉 TRUST ISSUES AND A BANKING LESSON

This event goes beyond a personal anecdote; it raises serious questions about the technological and operational reliability of major banks.

- Operational Risk: A bank failing to notice an error of this magnitude for such a long period indicates systemic weaknesses. Therefore, this incident could erode the confidence of customers and investors in the bank’s internal audit mechanisms.

The Professor Wrong Deposit incident became a costly operational flaw lesson for the banking system.