Breaking News: Two Major Holdings Appointed Trustee In Comprehensive Stock Manipulation Probe

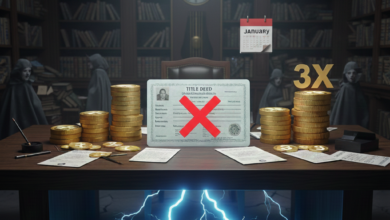

Capital Markets And Money Laundering Charges: Management Of Hat Holding And Investco Holding Transferred To The Savings Deposit Insurance Fund (TMSF)

ISTANBUL, Turkey – A critical legal measure has been taken in a major investigation, led by the Istanbul Chief Public Prosecutor’s Office’s “Bureau for the Prevention of Terrorism Financing and Money Laundering Crimes,” which has significantly impacted the Turkish stock market. The Istanbul 3rd Criminal Judgeship of Peace ordered the seizure of assets belonging to Hat Holding A.Ş. and Investco Holding A.Ş.—both publicly traded entities known for high-volume transactions—and transferred their management to the Savings Deposit Insurance Fund (TMSF). This decision directly targets two large holdings at the center of allegations concerning market manipulation and money laundering.

📝 PROSECUTOR’S STATEMENT: ORGANIZED CRIME AND MANIPULATION CHAIN

According to the official statement from the Chief Public Prosecutor’s Office, the investigation centers on three main criminal axes: Violation of the Capital Markets Law, Establishing an Organization to Commit a Crime, and Laundering Assets Derived from Crime.

- Organization’s Activities: The investigation revealed that the suspects operated under the umbrella of a criminal organization. The organization systematically manipulated the holdings’ financial statements. Furthermore, they created artificial price movements and utilized false Public Disclosure Platform (KAP) statements to control market actions, resulting in the artificial inflation and deflation of share values. By this method, they obtained illicit gains, defrauding numerous small investors.

- Laundering Illicit Gains: The scale of the illicit gains runs into billions of Turkish Lira. Therefore, the criminal organization established a complex network of financial transactions and shell companies to conceal the source of these funds and make them appear legitimate.

- International Scope: There are also allegations of an international dimension to the investigation, with some transactions conducted through accounts abroad.

🛡️ WHY WAS TMSF APPOINTED AS TRUSTEE? DUAL-LAYER PROTECTION

The decision to appoint the TMSF as trustee is a critical step aimed at ensuring the integrity of the legal process and protecting the rights of defrauded investors:

- Investor Protection Function: The most crucial reason for the Holdings Appointed Trustee decision is to preserve the value of the seized shares. Uncontrolled selling or devaluation due to the investigation could further harm good-faith investors. For this reason, the TMSF will oversee the management of the seized shares and ensure the continuation of the holdings’ operational activities.

- Security of Financial Records: The appointment of the TMSF protects the holdings’ financial records against the risk of evidence tampering. Thus, independent audits can trace the full extent of the manipulation and the flow of illicit profits.

- Scope: The order encompasses not only Hat Holding and Investco Holding—which were directly implicated in the organization’s activities—but also all shares held by the suspects in other publicly traded subsidiaries. Consequently, this directly or indirectly affects the management of numerous affiliated companies listed on the stock exchange.

📉 POTENTIAL IMPACT ON THE STOCK MARKET

A high-profile trustee appointment of this magnitude naturally caused apprehension on the Borsa Istanbul.

- Stock Trading: Following the decision, Borsa Istanbul initiated reviews regarding the trading status of the shares belonging to the designated holdings. However, the TMSF’s involvement ensures that operations will continue under control rather than being completely halted.

- Confidence Message: The Public Prosecutor’s Office targeting two such major holdings was perceived as a powerful message indicating the Capital Markets Board’s (SPK) resolve in combating manipulation. In conclusion, this Holdings Appointed Trustee decision could restore long-term confidence in the market.

The decision to appoint a trustee symbolizes the Turkish state’s highest-level commitment to combating money laundering and SPK crimes within the Turkish business and financial world.