BREAKING NEWS: CENTRAL BANK REVOKES PAPARA’S OPERATING LICENSE!

Major Crisis Hits Turkish FinTech Giant: Electronic Money License Canceled Following Allegations of Money Laundering and Illegal Gambling Facilitation. What Happens to Millions of Users?

ANKARA, Turkey – A monumental decision has been issued concerning Papara Elektronik Para A.Ş., one of Turkey’s most recognized and rapidly growing financial technology (fintech) firms. The Central Bank of the Republic of Turkey (TCMB) has officially revoked Papara’s license to issue electronic money and provide payment services following prolonged legal and administrative scrutiny. The decision was published in the Official Gazette on October 31, 2025, taking immediate effect and sending shockwaves across the entire fintech sector.

📜 Background and Official Grounds for Revocation

The cancellation of Papara’s operating license is not a sudden move but the culmination of a chain of legal proceedings that began in May 2025.

1. Allegations and Judicial Process

- Illicit Financial Circulation: An investigation launched by the Istanbul Chief Public Prosecutor’s Office alleged that Papara’s systems were being used to facilitate the financial circulation of illegal gambling proceeds. These claims highlighted the significant risk that digital wallets and virtual cards could be exploited as a mechanism for money laundering.

- Organized Crime Charges: The investigation involved 13 suspects, including the company’s founder and owner, Ahmed Faruk Karslı, who was charged with “leading an organized criminal group.” As part of the probe, seizure warrants were issued for numerous assets, including yachts, boats, vehicles, and real estate.

2. Appointment of Trustees and Administrative Control

- TMSF Intervention: In May 2025, the Savings Deposit Insurance Fund (TMSF) appointed trustees (kayyum) to eight companies linked to Papara’s parent company, PPR Holding A.Ş. This measure placed the company’s management and financial oversight under temporary state control.

- Final Decision: Ultimately, the TCMB, based on evaluations from the Banking Regulation and Supervision Agency (BDDK) and evidence from the judicial proceedings, decided to revoke the operating license. The official grounds cited the violation of relevant provisions under Law No. 6493 on Payment and Securities Settlement Systems, Payment Services, and Electronic Money Institutions.

📢 Assurance to Users: What Will Happen to Balances?

Given that Papara serves millions of active users across Turkey, the license revocation immediately sparked confusion and anxiety regarding the status of user accounts and balances. Both the TCMB and Papara have provided critical assurances:

- Legal Guarantee: Law No. 6493 mandates that electronic money institutions must hold customer funds in segregated accounts, separate from the company’s operating capital. This legal safeguard ensures that customer money is protected independently of the company’s commercial risks.

- Papara’s Statement: The company issued a public statement clarifying that the revocation only applies to Papara Elektronik Para A.Ş. and does not affect the operations of its other group companies, such such as Papara Securities and Papara Insurance Brokerage Services. They further guaranteed that they will fulfill their existing obligations and the process for reimbursing customer assets will be carried out in accordance with legal requirements.

- Practical Steps: Under the supervision of the TCMB and TMSF, users are expected to retain the ability to withdraw or transfer their existing balances to other bank or financial institutions. It is crucial for users to closely monitor and follow the detailed announcements to be made by the official institutions and the company.

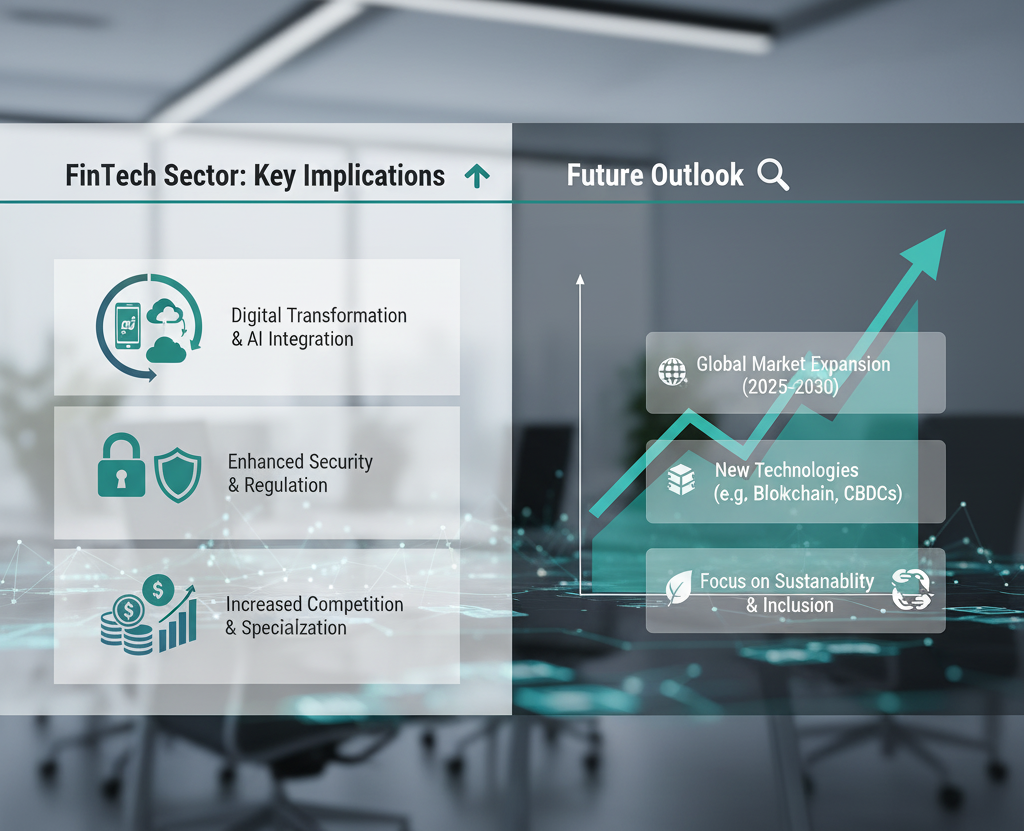

📈 Implications for the FinTech Sector and Future Outlook

The revocation of Papara’s license, a company that quickly became a driving force in Turkey’s fintech ecosystem since its founding in 2016, has immediate and far-reaching effects:

- Tightening Regulation: Experts believe this decision serves as a severe warning to all payment and electronic money institutions, signaling that the BDDK and TCMB will intensify their regulatory mechanisms. Technological and operational measures aimed at mitigating the risks of illegal gambling and money laundering are expected to be significantly bolstered across the sector.

- Focus on Trust: While consumer trust in digital wallet services may be momentarily shaken, the Central Bank’s swift and decisive action is viewed as a clear demonstration of its commitment to safeguarding the integrity of the financial system.

- Shifting Competition: Papara’s effective exit from the market opens up a new competitive landscape for other electronic money institutions and banks offering digital wallet services. A redistribution of market share is highly anticipated.

The revocation of Papara’s operating license marks the end of an era for the company and underscores that compliance and integrity within Turkey’s digital finance market will now be enforced under stricter rules.