Business

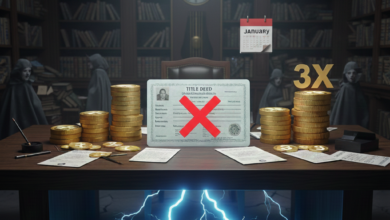

High-Interest Trap: Those Who Take Cash Advance From Credit Card Are Burned

Experts Warn: Drawing Cash Advance Instantly Incurs High Interest And Rapidly Lowers Credit Score

ANKARA, Turkey – Rising living costs push many consumers to take cash advances from their credit cards. However, financial advisors stated that this seemingly easy transaction instantly incurs high interest and rapidly lowers the credit score, resulting in significant long-term costs. Banks widely view taking a Cash Advance From Credit Card as a sign of high-risk borrowing.

📝 Section 1: Why Cash Advance Lowers The Credit Score

Financial experts note that while many people consider a cash advance harmless, the banking system penalizes the transaction from the start.

- Risk Perception: From the bank’s perspective, a cash advance indicates that the individual is experiencing a cash shortage and is engaging in risky borrowing. Consequently, a significant drop in the credit score occurs immediately.

- Long-Term Effects: Experts emphasize that this situation can lead to negative results not only in loan applications but also in car loans, personal loans, and even mobile phone line contracts. This is because the system classifies the individual as a high-risk group.

- Cost Burden: The cash advance incurs extra costs for the consumer due to interest accrual, while simultaneously causing a rapid decline in the credit score.

🛡️ Section 2: The Most Effective Ways To Maintain A High Credit Score

Experts listed simple yet effective financial steps consumers should take to prevent their credit scores from dropping unknowingly. Maintaining a high credit score is critical for future financial applications.

- Avoid Cash Advances: Banks interpret this as high-risk behavior. Taking a Cash Advance From Credit Card is an action that must be avoided.

- Pay On Time: Always pay bills and credit card payments promptly. Every late payment quickly reduces the credit score.

- Stay Below Limit: Avoid using the entire credit card limit. Staying below 30 percent of the limit is considered safe and responsible usage.

- Do Not Close Old Accounts: A long account history indicates reliability. Closing old credit accounts can negatively affect the credit score.

- Regularly Check Report: Regularly monitor your credit report. Errors in records can cause unnecessary problems during credit applications.